Offshore Company Formation: Browse International Waters Safely

Offshore Company Formation: Browse International Waters Safely

Blog Article

Methods for Cost-Effective Offshore Company Development

When thinking about overseas firm development, the quest for cost-effectiveness comes to be an extremely important problem for services looking for to expand their procedures globally. In a landscape where fiscal carefulness preponderates, the strategies used in structuring overseas entities can make all the difference in attaining economic effectiveness and functional success. From navigating the complexities of territory selection to executing tax-efficient frameworks, the journey in the direction of developing an offshore presence is swarming with chances and difficulties. By checking out nuanced techniques that mix lawful conformity, economic optimization, and technological innovations, companies can start a course in the direction of offshore firm development that is both financially sensible and tactically audio.

Choosing the Right Jurisdiction

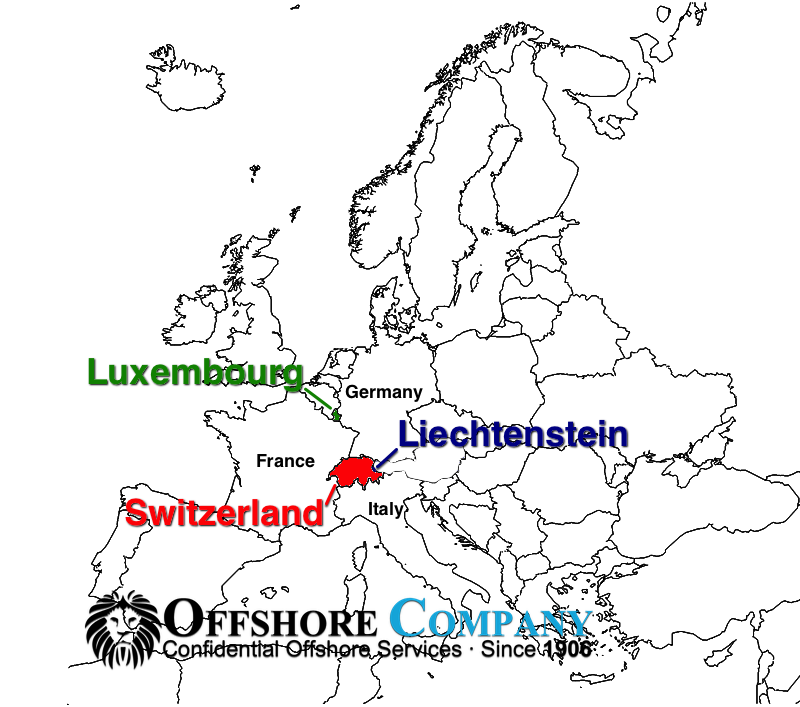

When developing an offshore firm, picking the ideal territory is an essential decision that can considerably impact the success and cost-effectiveness of the formation procedure. The territory picked will establish the regulative framework within which the firm operates, impacting tax, reporting needs, personal privacy regulations, and overall business versatility.

When choosing a territory for your offshore firm, a number of variables need to be considered to ensure the choice lines up with your calculated objectives. One vital aspect is the tax regime of the territory, as it can have a substantial influence on the firm's earnings. Additionally, the degree of regulatory compliance needed, the financial and political stability of the territory, and the simplicity of operating should all be evaluated.

In addition, the track record of the territory in the international business neighborhood is necessary, as it can influence the assumption of your business by customers, partners, and banks - offshore company formation. By thoroughly assessing these aspects and seeking professional advice, you can pick the right territory for your overseas business that maximizes cost-effectiveness and supports your service goals

Structuring Your Firm Successfully

To ensure ideal performance in structuring your overseas company, meticulous interest needs to be offered to the business framework. The first step is to specify the company's ownership framework plainly. This includes figuring out the investors, directors, and officers, along with their obligations and roles. By establishing a clear possession framework, you can make certain smooth decision-making processes and clear lines of authority within the business.

Next, it is vital to consider the tax ramifications of the chosen framework. Various jurisdictions supply differing tax obligation benefits and incentives for offshore firms. By meticulously examining the tax regulations and laws of the chosen jurisdiction, you can maximize your business's tax obligation performance and lessen unneeded expenses.

Furthermore, maintaining proper documents and documents is essential for the reliable structuring of your offshore firm. By maintaining current and precise records of economic purchases, company decisions, and compliance files, you can ensure transparency and liability within the company. This not only facilitates smooth procedures but likewise assists in showing conformity with regulative demands.

Leveraging Modern Technology for Savings

Efficient structuring of your offshore business not only depends upon precise best site attention to organizational structures however also on leveraging modern technology for financial savings. In today's electronic age, modern technology plays a crucial role in improving processes, reducing expenses, and raising performance. One method to leverage modern technology for savings in offshore business formation is by making use of cloud-based solutions for information storage and cooperation. Cloud innovation gets rid of the need for pricey physical framework, decreases upkeep expenses, and provides versatility for remote job. Additionally, automation tools such as digital signature systems, accounting view it now software program, and project monitoring systems can significantly minimize hands-on labor prices and boost total productivity. Embracing online interaction devices like video clip conferencing and messaging applications can additionally lead to cost savings by lowering the requirement for travel expenses. By incorporating innovation purposefully right into your overseas business formation procedure, you can achieve significant cost savings while boosting functional effectiveness.

Lessening Tax Obligation Liabilities

Utilizing tactical tax planning techniques can effectively decrease the financial worry of tax obligations for overseas firms. Among the most usual approaches for lessening tax responsibilities is through revenue changing. By distributing profits to entities in low-tax jurisdictions, overseas companies can legally lower their general tax obligations. Furthermore, taking advantage of tax obligation motivations and exceptions offered by the territory where the overseas firm is registered can result in substantial financial savings.

An additional strategy to decreasing tax obligations is by structuring the overseas company in a tax-efficient manner - offshore company formation. This entails carefully designing the possession and functional framework to optimize tax obligation advantages. As an example, setting up a holding business in a territory with favorable tax obligation laws can help minimize and consolidate earnings tax obligation exposure.

Moreover, staying upgraded on global tax regulations and compliance demands is vital for reducing tax liabilities. By making sure rigorous adherence to tax laws and guidelines, offshore firms can avoid expensive fines and tax obligation disagreements. Seeking specialist recommendations from tax obligation experts or lawful experts concentrated on worldwide tax issues can also supply beneficial insights right into effective tax obligation preparation methods.

Making Certain Conformity and Threat Reduction

Implementing robust conformity steps is essential for overseas firms to reduce risks and preserve regulative adherence. To make sure compliance and reduce dangers, offshore business need to perform comprehensive due persistance on clients and company companions to avoid participation in immoral activities.

Additionally, staying abreast of changing guidelines and legal needs is crucial for offshore companies to adapt their compliance practices appropriately. Engaging lawful experts or compliance consultants can offer valuable guidance on navigating complex governing landscapes and guaranteeing adherence to international criteria. By focusing on conformity and threat reduction, overseas business can improve transparency, develop trust with stakeholders, and safeguard their operations from potential legal consequences.

Verdict

Using strategic tax planning methods can properly reduce the monetary concern of tax obligation obligations for overseas firms. By dispersing earnings to entities in low-tax jurisdictions, overseas firms can lawfully reduce their total tax obligation commitments. In addition, taking benefit of tax motivations and exceptions provided by the jurisdiction where the offshore firm is signed up can result in substantial savings.

By ensuring strict adherence to tax obligation laws and guidelines, offshore firms can avoid expensive penalties and tax obligation conflicts.In verdict, economical overseas company formation calls for cautious consideration of territory, effective structuring, modern technology usage, tax obligation reduction, and conformity.

Report this page